German carmakers

Stuck in third

Daimler is set to keep chugging down the Autobahn behind BMW and Audi

Nov 9th 2013 |From the print edition

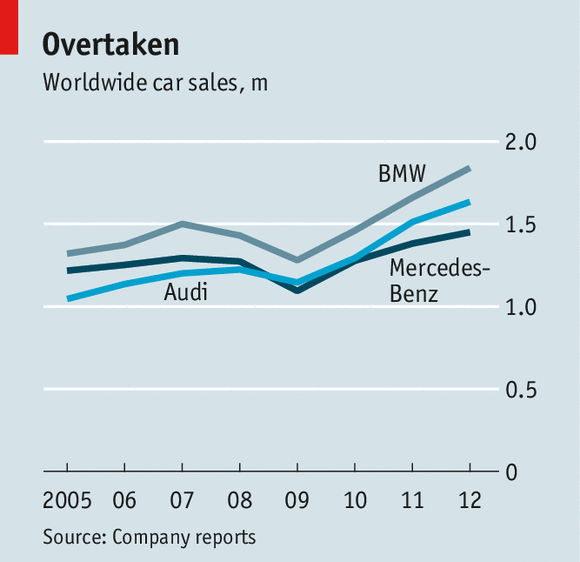

AS A corporate motto, “The best or nothing” has a timeless quality. Gottlieb Daimler pasted it on the wall as he went about inventing the modern car in the late 19th century. In 2010 the firm that bears his name adopted it as a slogan. It was as badly timed as a misfiring engine. Mercedes-Benz, Daimler’s car division, already trailing BMW in terms of sales and profitability, saw another Geman premium carmaker, Audi, also start to pull away in the same year (see chart). Yet this year Daimler’s shares have surged by 40%, persuading optimists that the firm is catching up. This week it said its worldwide sales in October had risen 15% year-on-year to a new record.

Dieter Zetsche, Daimler’s boss, is confident. At the Frankfurt motor show in September he reiterated that his firm can become the world’s top premium carmaker by 2020, helped by the launch of a fleet of new models. Before this year’s rally, Daimler’s shares were roughly where they were when Mr Zetsche took over in 2006, whereas BMW’s had doubled.

Mr Zetsche has completed Daimler’s return to its core business of making premium cars after years of costly errors. An attempt in the 1990s to turn it into a transport conglomerate, adding planes, trains and even spaceships to the mix, had ended in failure. Mr Zetsche presided over the demise of Daimler’s stab at becoming a global car giant by merging with Chrysler and allying with Mitsubishi and Hyundai. He sold the American carmaker at a spanking loss, the year after he took over. Fiat of Italy now controls it.

These activities had distracted Daimler from the business of making classy cars. The entry-level A Class, introduced in 1997 and intended to induce a new generation to the Mercedes brand, was a flop; Smart, a frugal city car, was a financial disaster. A dull mid-range E Class failed to meet buyers’ expectations of a luxury barge. Worse still, the reliability of its cars fell and its reputation for engineering excellence waned.

In the past couple of years Daimler has issued profit warnings even as pricey cars have prospered, outgrowing the market as a whole. Mercedes’s image as a car for the grey-haired has held it back. By concentrating its efforts on saloons, it missed out as BMW and Audi grabbed a share of the hottest new part of the market—SUVs. Meanwhile those competitors also stretched the definition of a premium-segment car by introducing luxurious smaller models.

Daimler is now trying to put that right with its new models. The new GLA, launched at Frankfurt, and a GLK, set for the roads in 2015, will at last give smaller BMW X Series and Audi Q range SUVs some serious competition. In small cars the CLA, a pint-size saloon, is in a niche of its own. The launch of new models in the range-topping S Class will also boost sales.

Daimler is following BMW and Audi in making a broader range of vehicles to suit more tastes. It should improve profitability, which has lagged the consistent 9-10% margins of its two rivals, by reducing its main platforms, the basic underpinnings of its vehicles, from four to two. More standardisation and common parts, and faster development times for new models, should lower costs. But BMW and Audi have similar plans and may well do a better job. Both of Daimler’s German rivals have a more efficient workforce that toils for lower pay. BMW sells 30% more cars with the same number of workers, says Morgan Stanley, a bank.

In China, the world’s biggest market for cars of all price brackets, Daimler arrived late and entered a joint venture with a local firm (as the government requires) on unfavourable terms. BMW outsells Mercedes by 70%; Audi sells twice as many cars. But Daimler has now tidied up a messy dealership network in which outlets selling imports and ones selling locally made cars had competed with each other. Now it needs to speed up the opening of new showrooms in smaller inland cities.

Daimler’s technology, the key to meeting increasingly strict emissions targets, also lags its rivals’. BMW has left it standing with the launch of its new range of electric cars. Catching up will be hard. BMW, controlled by the Quandt family, has steady leadership that can back long-term research and development. Audi can draw on the vast resources of its parent, VW. Harald Hendrikse of Nomura, a bank, sees Mercedes, more sensitive to the whims of investors and the quarterly reporting cycle, as more short-termist and conservative.

Despite its bumpy ride Daimler still has a strong brand and decent revenues from cars as well as a solid truck, van and bus business. And compared with the rest of the global car industry it is nicely profitable. Critics say that Daimler’s bosses are a little disconnected from reality in claiming that the firm will one day lead the pack again. But it is probably a better management ploy than sticking up a sign saying “Third-best or nothing”.

No comments:

Post a Comment