MITSloan Management Review

Magazine: Winter 2014

Glen Schmidt and Bo van der Rhee

A research-based framework identifies six positioning options for new products or services.

Should a new product or service start at the high end of the market

and then move downward? Or is it wiser to launch a new offering at the

low end, and then move up?

In truth, there’s no one-size-fits-all approach for how new products enter the market. That’s why we and our colleague Joseph Van Orden have developed a framework to help you choose an approach. There are two key questions to ask: (1) Is the basic functionality of our new offering better or worse than that of existing competitive products? (2) How groundbreaking are the novel attributes of the new product?

Consider the Nintendo Wii and the Tesla Roadster. One is a video game console that was introduced at $250. The other is an electric car introduced at $109,000. Each illustrates a different approach to positioning a new product.

The Wii attracted a new type of customer to the video game market; Nintendo decided not to compete head-on with Microsoft’s high-performance Xbox 360 and Sony’s high-performance PlayStation 3. Both of these competitors had much faster processing power and high-end graphics, traditionally the “core attributes” of product performance in the video game industry. Instead of competing on those core attributes, where the Wii offered less functionality, the Wii instead included a somewhat novel “new attribute” — its easy-to-use motion-sensitive controller, dubbed the “Wii-mote.”

Like the Wii, the Tesla Roadster offered a novel attribute — in this case, electric propulsion. But unlike the Wii, the Roadster did not make sacrifices to the “core attributes” of product performance in its industry. Instead, the Roadster closely matched the acceleration and ride of high-performance cars such as the Porsche 911.

Hardcore gamers never viewed the Wii as a replacement for the Xbox 360 or PlayStation 3, and the Wii was never marketed that way. By contrast, performance-oriented drivers took the Roadster seriously. The Roadster was marketed head-to-head against other high-performance vehicles, as something drivers could buy if they wanted the “new attribute” — electric propulsion — without sacrificing performance.

Both the Wii and Tesla progressively attacked an existing market (we say they “encroached on” the market), but the Wii was priced at the lower end of its market and thus encroached from the low end upward, while the Tesla Roadster encroached from the high end downward.

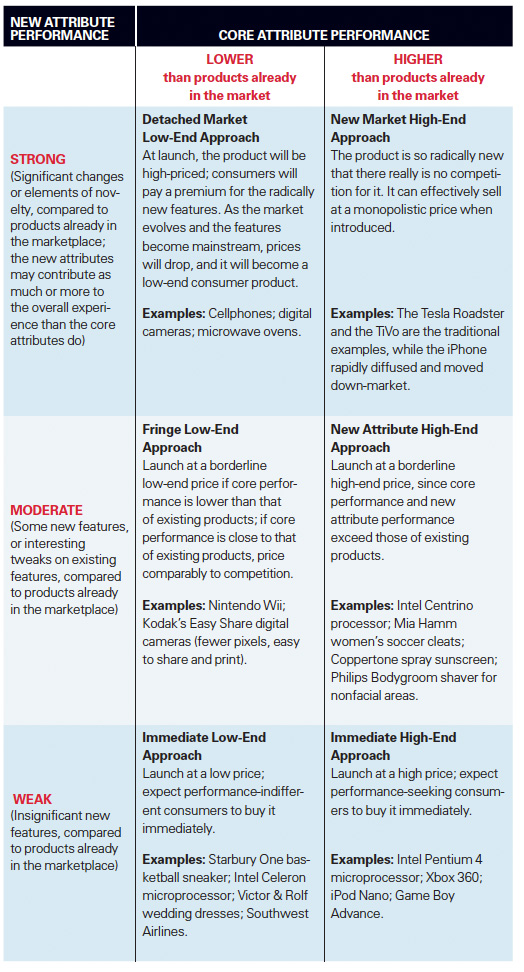

Of course, not every new low-end product features a noticeable new attribute like the Wii did. Nor does every new high-end product feature a landmark new attribute as the Roadster does. For that reason, we developed a framework that could accommodate new attributes of varying significance. Some new products don’t have any significant new attributes; they are hoping to gain market share based strictly on price point and/or core attributes. That’s why we’ve sorted both low-end and high-end product launch approaches into three distinct categories (strong, moderate and weak), depending on the strength (or lack thereof) of the product’s new attribute. Using this method, we describe a framework of six potential strategies for new products: three high-end, three low-end. (See “Six Ways to Position a New Product or Service.”) We then consider when a company should adopt one or more of the six approaches. (See “Related Research” for more detailed articles on this framework that we published in the Journal of Product Innovation Management.)

When to Pursue It: When large groups of customers are reluctant to pay the higher prices associated with current offerings, they may be receptive to lower-priced products with weaker core attribute performance. This is particularly true if the core attribute performance of the current products overshoots the needs of these customers.

When to Pursue It: This approach works best when customers will appreciate higher core attribute performance — and when cost reductions are readily achievable over time.

When to Pursue It: Successful fringe market low-end new products must attract new customers who previously were not interested in purchasing this type of product because of the high price. The existence of this type of customer is usually related not only to a comparatively high sticker price, but also to a lack of need for the high core attribute performance offered by the original products. The video game industry discovered that some people were not interested in games requiring complicated multibutton controllers. Nintendo listened and came up with the Wii. For this approach, listening to non-customers is key.

When to Pursue It: This approach works well when customers in the existing market are looking for added functionality but are not willing to sacrifice existing functionality. Other examples include the PlayStation 2, which also played DVDs; Dutch Boy’s Twist & Pour paint containers that reduced spilling; easy-squeeze plastic ketchup bottles; and Oakley sunglasses with a built-in MP3 player.

Over time, the mobile phone improved immensely on core attribute performance. The price has come down dramatically, to the point where many lower-end customers, such as college students, have dropped landline subscriptions in favor of mobile-only calling. In other words, mobile phones started out selling to a separate new market — which we call a detached market — at high prices but eventually moved in on the low end of the traditional landline market. That’s why we call this the detached-market low-end approach. Another example is the digital camera. Initially, it offered very poor picture quality. Eventually, as quality improved, it encroached on traditional film cameras.

When to Pursue It: This approach works when customers are willing to pay a high price for a new product, even though the core attribute performance is weak. But remember: Customers will only do so when the new attribute performance is radically different and fills a strong need — possibly a need they did not even know they had.

When to Pursue It: Sometimes you may be able to offer a powerful new attribute without sacrificing core attribute performance. For example, the iPhone was introduced at a high price by offering a package of features previously unknown to cellphone users. The iPhone then soon decreased its price to encroach on the market of other smartphones. Pursue the new-market high-end approach when you have access to a new technology or capability that can offer a dramatically improved product that high-end customers “have to have.” Preferably, the cost can be reduced over time to facilitate a move down-market.

Consider whether your new product might be able to approach from the high end on one market and simultaneously from the low end on another market. An example is Cisco’s TelePresence, which facilitates virtual meetings while participants remain in their own offices. While this product is high end compared to other such digital solutions (ranging from conference calls to Google Hangouts to Skype), it is low end compared to business travel to have a meeting in person. Another example is Southwest Airlines, which when it launched was low end relative to other airlines, but high end relative to driving; early customers chose to fly Southwest rather than having to drive from Dallas to Austin, for example.

Consider the rate at which you will be able to make improvements to the new product. With high-end approaches, moving down-market depends on your ability to reduce price. With low-end approaches, moving up-market depends on your ability to enhance core attribute performance.

Properly positioning a new product is a complex undertaking — one that will never be done with perfect knowledge. However, our framework of six possible approaches can provide a context from which to “ask the right questions,” so that innovation managers can develop expectations about which market segments a new product will sell to initially — and which market segments it will move in on as time progresses.

In truth, there’s no one-size-fits-all approach for how new products enter the market. That’s why we and our colleague Joseph Van Orden have developed a framework to help you choose an approach. There are two key questions to ask: (1) Is the basic functionality of our new offering better or worse than that of existing competitive products? (2) How groundbreaking are the novel attributes of the new product?

Consider the Nintendo Wii and the Tesla Roadster. One is a video game console that was introduced at $250. The other is an electric car introduced at $109,000. Each illustrates a different approach to positioning a new product.

The Wii attracted a new type of customer to the video game market; Nintendo decided not to compete head-on with Microsoft’s high-performance Xbox 360 and Sony’s high-performance PlayStation 3. Both of these competitors had much faster processing power and high-end graphics, traditionally the “core attributes” of product performance in the video game industry. Instead of competing on those core attributes, where the Wii offered less functionality, the Wii instead included a somewhat novel “new attribute” — its easy-to-use motion-sensitive controller, dubbed the “Wii-mote.”

Like the Wii, the Tesla Roadster offered a novel attribute — in this case, electric propulsion. But unlike the Wii, the Roadster did not make sacrifices to the “core attributes” of product performance in its industry. Instead, the Roadster closely matched the acceleration and ride of high-performance cars such as the Porsche 911.

Hardcore gamers never viewed the Wii as a replacement for the Xbox 360 or PlayStation 3, and the Wii was never marketed that way. By contrast, performance-oriented drivers took the Roadster seriously. The Roadster was marketed head-to-head against other high-performance vehicles, as something drivers could buy if they wanted the “new attribute” — electric propulsion — without sacrificing performance.

Both the Wii and Tesla progressively attacked an existing market (we say they “encroached on” the market), but the Wii was priced at the lower end of its market and thus encroached from the low end upward, while the Tesla Roadster encroached from the high end downward.

Of course, not every new low-end product features a noticeable new attribute like the Wii did. Nor does every new high-end product feature a landmark new attribute as the Roadster does. For that reason, we developed a framework that could accommodate new attributes of varying significance. Some new products don’t have any significant new attributes; they are hoping to gain market share based strictly on price point and/or core attributes. That’s why we’ve sorted both low-end and high-end product launch approaches into three distinct categories (strong, moderate and weak), depending on the strength (or lack thereof) of the product’s new attribute. Using this method, we describe a framework of six potential strategies for new products: three high-end, three low-end. (See “Six Ways to Position a New Product or Service.”) We then consider when a company should adopt one or more of the six approaches. (See “Related Research” for more detailed articles on this framework that we published in the Journal of Product Innovation Management.)

Mapping New Products to the Framework

1. Immediate

Low-End Approach If your product’s new attribute performance is “weak” — and its core attribute performance is lower than that of many competing products already in the marketplace — its price will need to be lower, for the product will sell only to those price-conscious customers who don’t need all the performance that current products offer. The good news is that the lower price will help immediately attract these low-end customers.When to Pursue It: When large groups of customers are reluctant to pay the higher prices associated with current offerings, they may be receptive to lower-priced products with weaker core attribute performance. This is particularly true if the core attribute performance of the current products overshoots the needs of these customers.

2. Immediate

High-End Approach If the new product offers higher core attribute performance, it will typically be priced higher than the incumbent products. Only customers clamoring for more performance will be willing to pay the higher price. An example of this approach was Intel’s introduction of the Pentium 4 microprocessor at a time when the Pentium III was its flagship product. The Pentium 4 offered higher performance, and it immediately sold to performance-conscious consumers at the high end of the market. “New and improved” products often follow this strategy; it is the most common positioning strategy for new products.When to Pursue It: This approach works best when customers will appreciate higher core attribute performance — and when cost reductions are readily achievable over time.

3. Fringe Market Low-End

Approach While high-end customers often seek peak levels of core performance, there are opportunities at the low end of the market for new products that sacrifice core performance in return for something novel — something like the Wii gaming system’s motion-sensitive controller. Since these products have lower core performance than the competition, they may be priced lower than the competition. (On the other hand, if the core performance is diminished only slightly, and the new attribute is enticing enough, the product may be priced comparably or even marginally higher.) This type of new product can greatly expand a market because it sells to previous nonbuyers on the “fringe” of the existing market. The Wii, for example, greatly expanded the market for gaming systems.When to Pursue It: Successful fringe market low-end new products must attract new customers who previously were not interested in purchasing this type of product because of the high price. The existence of this type of customer is usually related not only to a comparatively high sticker price, but also to a lack of need for the high core attribute performance offered by the original products. The video game industry discovered that some people were not interested in games requiring complicated multibutton controllers. Nintendo listened and came up with the Wii. For this approach, listening to non-customers is key.

4. New Attribute High-End

Approach This approach is suited for a product with moderate new attribute performance, in addition to higher core attribute performance. An example is the Intel Centrino microprocessor. It offered enhanced wireless capability (a new attribute) in addition to faster processing (a core attribute) compared to other chips on the market at the time of its introduction. Another example is the Mia Hamm women’s soccer shoe, created with leather that does not expand or get overly slick when it gets wet (a new attribute) — ensuring stability and handling of the ball in rainy conditions. In such cases, the higher core attribute performance and the moderate new attribute performance suggest that high-end customers will be willing to pay more for the product, leading to a higher price.When to Pursue It: This approach works well when customers in the existing market are looking for added functionality but are not willing to sacrifice existing functionality. Other examples include the PlayStation 2, which also played DVDs; Dutch Boy’s Twist & Pour paint containers that reduced spilling; easy-squeeze plastic ketchup bottles; and Oakley sunglasses with a built-in MP3 player.

5. Detached Market Low-End Approach

When the first mobile phone was introduced, it offered terrible core attribute performance. Frequently, there were dropped calls. Coverage was sporadic. Furthermore, the first mobile phones were bulky, weighing about two pounds. The final insult was that such phones cost more than $4,000 in 1984 dollars. However, the mobile phones offered something no landline could provide: calling on the go. The early mobile phone sold to certain customers, such as construction foremen at worksites where there were no phone jacks, who accepted the poor reception as long as they could make calls while not in an office.Over time, the mobile phone improved immensely on core attribute performance. The price has come down dramatically, to the point where many lower-end customers, such as college students, have dropped landline subscriptions in favor of mobile-only calling. In other words, mobile phones started out selling to a separate new market — which we call a detached market — at high prices but eventually moved in on the low end of the traditional landline market. That’s why we call this the detached-market low-end approach. Another example is the digital camera. Initially, it offered very poor picture quality. Eventually, as quality improved, it encroached on traditional film cameras.

When to Pursue It: This approach works when customers are willing to pay a high price for a new product, even though the core attribute performance is weak. But remember: Customers will only do so when the new attribute performance is radically different and fills a strong need — possibly a need they did not even know they had.

6. New Market High-End Approach

The Tesla Roadster’s fully electric propulsion system was a new attribute in a car that also had strong core attribute performance. The resulting product was so radically new that there really was no competition for it, and it effectively created a new market. Other examples include TiVo (the first product that enabled consumers to digitally record television and skip commercials) and the Slingbox (a product that lets consumers watch television on their laptops).When to Pursue It: Sometimes you may be able to offer a powerful new attribute without sacrificing core attribute performance. For example, the iPhone was introduced at a high price by offering a package of features previously unknown to cellphone users. The iPhone then soon decreased its price to encroach on the market of other smartphones. Pursue the new-market high-end approach when you have access to a new technology or capability that can offer a dramatically improved product that high-end customers “have to have.” Preferably, the cost can be reduced over time to facilitate a move down-market.

Lessons for Innovation Managers

Sincerely consider multiple approaches. Toward the end of his book The Innovator’s Dilemma, Clayton Christensen lays out a possible scenario for the electric car. Effectively, he suggests the electric car will gain traction via a low-end approach. But as it turns out, Tesla is expecting to make inroads in just the opposite way, with a high-end strategy. As this example illustrates, more than one approach to a market is possible, and every organization should consider alternatives.Consider whether your new product might be able to approach from the high end on one market and simultaneously from the low end on another market. An example is Cisco’s TelePresence, which facilitates virtual meetings while participants remain in their own offices. While this product is high end compared to other such digital solutions (ranging from conference calls to Google Hangouts to Skype), it is low end compared to business travel to have a meeting in person. Another example is Southwest Airlines, which when it launched was low end relative to other airlines, but high end relative to driving; early customers chose to fly Southwest rather than having to drive from Dallas to Austin, for example.

Consider the rate at which you will be able to make improvements to the new product. With high-end approaches, moving down-market depends on your ability to reduce price. With low-end approaches, moving up-market depends on your ability to enhance core attribute performance.

Properly positioning a new product is a complex undertaking — one that will never be done with perfect knowledge. However, our framework of six possible approaches can provide a context from which to “ask the right questions,” so that innovation managers can develop expectations about which market segments a new product will sell to initially — and which market segments it will move in on as time progresses.

Six Ways to Position a New Product or Service

When choosing a positioning approach for a new product or service, there are two key questions to consider: (1) Is the basic functionality of our new offering better or worse than that of existing competitive products? (2) How groundbreaking are the novel attributes of the new product?

No comments:

Post a Comment